Ahmedabad top contributor to VAT followed by Surat as distant second

March 13, 2015

Gandhinagar

Some interesting details on Value Added Tax(VAT) figures from some districts have come to light through replies of Finance Minister Saurabh Patel in assembly today.

-Ahmedabad is top contributor of VAT. In 2014-15 Ahmedabad contributed Rs. 8,464.74 crore to total VAT collection of Gujarat. Maximum revenue was from Automobile and Auto parts, mobile phone, tobacco products, home appliances, coal, coke, lignite.

-Surat: Rs. 3145.68 crore, maximum revenue through natural gas, yarn, iron steel, automobile and machinery.

-Jamnagar: Rs. 1429.42 crore, maximum revenue through petroleum products, brass parts, automobiles, cement, scrap.

-Kutch: Rs. 995.20 crore, maximum revenue through iron(Rs. 176 crore), cement(Rs. 100 crore), timber(Rs. 99 crore), chemicals(Rs. 93 crore), food processing(Rs. 50 crore).

-Rajkot: Rs. 732.54 crore, maximum revenue through automobiles, cotton, food products, chemicals, and cement.

-Anand: Rs. 503.73 crore.

-Kheda: Rs. 182.54 crore maximum revenue through beverages, tobacco products, auto and auto parts, cement products, petro and disel.

-Surendranagar: Rs. 97.68 crore, maximum revenue through auto, agri products, cotton, petrol, diesel, sanitary wear.

-Narmada: Rs. 8.79 crore, maximum revenue through mainly sugarcane, molasses, petrol, diesel, greet/metal, grocery, footwear

-Mahisagar: Rs. 5.64 crore, maximum revenue through petrol, diesel, mine, cement pole, medicines.

All figures upto 31-12-2014 in 2014-15 fiscal year.)

Government has set up e-payment facility covering 18 banks. Rs. 36,200 crore VAT was paid through e-payment mode.

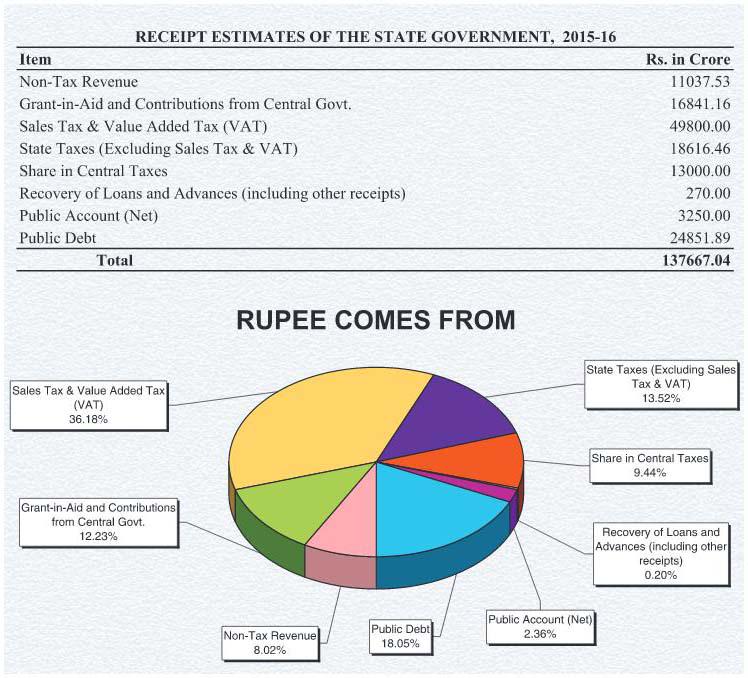

Gujarat government’s over 36% revenue is through VAT.

© Copyright DeshGujarat. All rights reserved. Republication or redistribution of any DeshGujarat content, including by framing or similar means, is expressly prohibited without their prior written consent.

Related Stories

Recent Stories

- Jamsaheb calls for Rajput unity; Asks to ensure defeat

- Large quantity of substandard oil being sold under branded label seized in Valsad

- Bomb threat at VR Mall in Surat; public evacuated, probe on

- With tears in eyes, Police Inspector tenders apology in Surat Court

- Rajkot Royal Mandhatasinh Jadeja comes in support of Rupala

- Viral video of two-year old child driving a bike; Police nab accused Taufik

- Atal bridge, walkways of Riverfront to remain open till 11 pm