RIL Q3 | All time high revenue and EBITDA

January 22, 2022

Mumbai: Reliance Jio beat street estimates on the profitability front in the third quarter while the revenues were in-line with expectations. Revenues for Q3 came in at Rs 19,347 crore against Rs 18,735 crore in the September quarter – an increase of 3.3%.

Net profit was up 2.5% at Rs 3,615 crore versus Rs 3,528 crore logged in the second quarter. The operational performance beat the street expectations with EBITDA margins at 49.2% vs 48% in the last quarter. ARPU jump of 5.6% to Rs 151.60 was a positive surprise aided by tariff hike and subscriber mix.

Jio took a tariff hike of 20% in the quarter across its pre and post-paid plans which led to two important developments – improvement in ARPU and a shift in the subscriber mix to more quality customers.

Jio management said in the press briefing, “Margins close to 50% is an important milestone and the full upside of tariff hike will reflect in its performance in the next few quarters.”

Jio’s subscriber base has seen a second consecutive quarter of decline due to SIM consolidation. The company said that low-end customers with two SIMs have deactivated during the quarter, a trend seen in the last quarter as well. Jio ended Q3 with a net subscriber base of 421 million which is a decline of 8.5%. In Q2, the subscriber base for the telecom giant fell by 11.1%. Jio witnessed gross additions of 34.6 million subscribers in the quarter gone by.

Jio management said, “Subscriber quality has improved to high usage customer additions. Tariff hike also led to SIM consolidation at low usage subscriber base and also let to a transition to long-term plans for many users.”

Jio also prepaid Rs 30,791 crore of deferred spectrum liability during Q3 which will lead to an annual cost savings of Rs 1,200 crore, management shared. Reliance Industries which was net debt-free in the second quarter ended Q3 with Rs 2,862 crore of net debt on account of replacing high coupon debt with low-cost foreign bonds which were largely used to prepay spectrum liabilities.

On the 5G thrust, Jio has completed the coverage planning in 1,000 cities and is on trial stage in several cities. Jio shared, “We are preparing to be ready by the time we receive government approvals to roll out 5G services.”

Most analysts are positively surprised with the ARPU jump in Q3 but are keenly watching the continued fall in the subscriber base of Reliance Jio. The company sounded a positive note on the new phase of growth in the telecom sector with tariff hike and the government’s recent decisive steps to uplift the telecom sector.

Reliance Retail

Reliance Retail, the retail arm of oil-to-telecom conglomerate Reliance Industries, reported a strong performance and beat street expectations in the third quarter (Q3) of the financial year 2022 as consumer demand rebounded led by festive period and the easing of movement curbs across the country.

The company reported a 23 percent year-on-year (YoY) jump in its consolidated net profit at Rs 2,259 crore for the quarter ended December as compared to Rs 1,830 crore in the corresponding period last year. Its revenue from operations (consolidated) climbed over 53 percent YoY to Rs 50,654 crore in Q3 FY22 as compared to Rs 33,018 crore reported last year.

A CNBC-TV18 poll of analysts had projected Reliance Retail to report a revenue of Rs 45,450 crore for Q3.

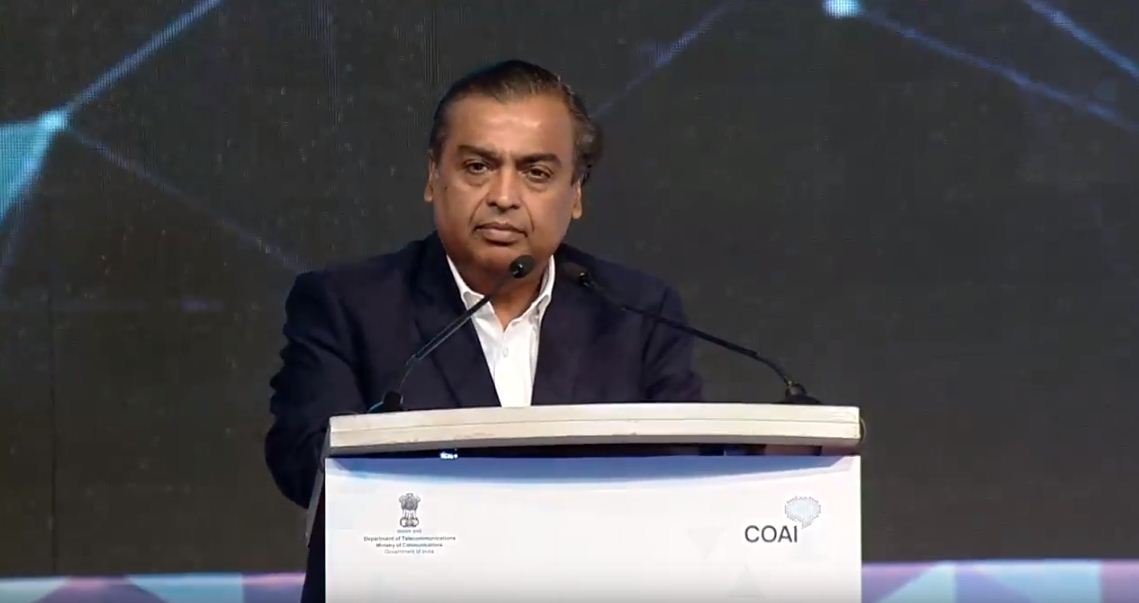

“Both our consumer businesses, retail and digital services have recorded highest ever revenues and EBITDA. During this quarter, we continued to focus on strategic investments and partnerships across our businesses to drive future growth. Retail business activity has normalised with strong growth in key consumption baskets on the back of festive season and as lockdowns eased across the country,” Mukesh D. Ambani, Chairman and Managing Director, Reliance Industries, said in a statement.

Reliance Retail’s EBITDA from operations during the quarter stood at Rs 3,522 crore, 52 percent higher than Rs 2,312 crore reported in the year-ago period. Reliance Retail’s EBITDA margin in Q3 stood flat at 7 percent.

Operational environment improves

Though the company witnessed sporadic disruption in December due to the COVID-19 third wave, overall footfalls during Q3 across segments of fashion, jewellery, grocery remained strong helping the company deliver a strong performance, said the company’s management during a virtual post-earnings call on January 21.

“The operating environment has been improving as the restrictions were eased through the quarter progressively. There was a build-up during the festive period and as normalcy returned, our footfalls reached almost pre-Covid levels at 95-97 percent,” said Gaurav Jain, head – strategy and business development, Reliance Retail. The footfalls in stores are up 30 percent as compared to the same period last year.

The company witnessed a festive mood in the market starting from Navratri in October till the wedding season in December. “Towards the end of December, there were sporadic disruptions because of the new Covid strain, but we were prepared and optimistic and were able to tackle the emerging challenges,” added Jain.

The company’s management said a better operating environment backed by its omnichannel capabilities helped it deliver its highest-ever revenue.

Reliance Retail opened 837 new stores across its retail brand in the December quarter taking its total store count to 14,412. The company now has 40.0 million square feet area of operation as compared to 31.2 million square feet in the corresponding quarter of the previous year. It also added 73 new warehousing and fulfilment centres with an area of 2.3 million square feet during the quarter.

Growth across categories

Reliance Retail reported strong sales across its products segments of grocery, consumer electronics, fashion and lifestyle, pharma etc.

“The revenue built up also has come from all our consumption baskets. The consumer electronics, as well as apparel and footwear have doubled their business led by customer buying, while grocery has maintained its consistent runway and also posted double-digit growth,” said Jain.

The company witnessed consistent double-digit growth in consumer electric stores as customers flocked back to the physical outlets. “Our average conversion value also jumped helping us clock some of our best sales during the festive season leading up to the wedding season,” he added.

Its digital platforms, too, surged led by festive demand. Ajio, the company’s management said, has added over 50 leading international and national brands to its platform and witnessed two-times growth in its monthly active users.

Reliance Retail’s digital-first lingerie brand Zivame posted its highest-ever quarterly sales in Q3 and crossed 100 store milestone in its offline expansion journey.

The way ahead

Going forward, the company’s management said that while the market is volatile due to the omicron variant, Reliance Retail is well-prepared to navigate its way through the challenges.

“And as the situation normalises our focus will remain on accelerating the growth momentum and also the expansion,” said Jain.

Reliance Retail will also continue to scale its digital commerce businesses across platforms and onboard new merchants across geographies.

“We will look at integrating all the acquisitions and also scale up these new businesses to the next level by providing them the right ecosystem support from Reliance Retail infrastructure and also continue to strengthen and sharpen our supply chain capabilities, product design and ecosystem in line with the business expansion,” he added. (MoneyControl)

Recent Stories

- ACB Gujarat files offence against SK Langa and son for disproportionate asset

- Kshatriya agitators announce part-2 programs in Gujarat

- FM Sitharaman on Gujarat visit on April 20th

- JNK India Limited’s IPO to open on April 23rd

- CR Patil files nomination papers from Navsari Lok Sabha seat

- Miscreants attempt to vandalize BJP office in Rajkot

- Amit Shah files nomination papers for Gandhinagar Lok Sabha seat